Key trends shaping the mining and metals sector in Southern Africa, Part 3: Resilience in an uncertain business environment

Organizations need to adapt to increasingly uncertain business environments with more disruption and risk than before, especially in Southern Africa. Some of these disruptions are specific to the region, such as deteriorating infrastructure, policy uncertainty, social unrest, and increasing operating costs. For example, South Africa has seen deterioration within energy infrastructure, translating into loadshedding increasing from 1,190 hours in 2021 to 1,900 hours 2022, and an 11% reduction on rail and port export capacity in the last year.

As a result, organizations are taking additional measures to build resilience. The implementation of various mitigation strategies is evidence of this—including Anglo American forming a renewable energy partnership with EDF, Rio Tinto partnering with Motorola to design and roll out a back-up communications solution for an Integrated Operating Centre (IOC), and a major client building resilient and innovative supply chain partnerships, including localization.

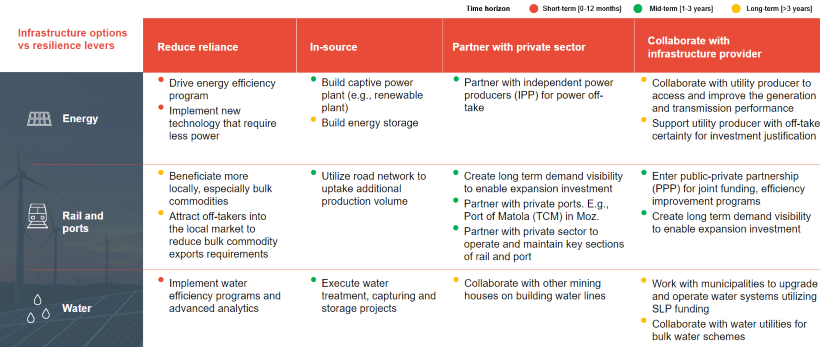

Infrastructure risk is top of mind for executives, particularly energy, water, rail, and ports. There are four key levers that organizations can use to address their systemic infrastructure risk

- Reduce infrastructure demand

- Build in-house infrastructure capabilities

- Partner with the private sector to reduce reliance on public infrastructure

- Collaborate with the public sector to resolve capacity constraints.

These four levers can be implemented over three horizons to build business resilience:

Short-term focus. This is largely centered around reducing infrastructure reliance and demand e.g., via energy and water efficiency programs.

Mid-term focus. This focus is premised around the in-sourcing of infrastructure capacity and partnering with the private sector through establishment of in-sourced renewable energy capacity and scaling up of water recycling and treatment projects.

Long-term focus. In the long-term, interventions are focused on collaboration with infrastructure providers and decreased reliance on bulk commodity export requirements through local beneficiation and offtake agreements.

Infrastructure resilience initiatives

An example of private sector collaboration is the formation of Intensive User Energy Group (IUEG) in Zimbabwe. Sustained power outages affect mining operations and industrial users with an 8,000 MW electricity deficit, representing 40% of installed capacity. This demand deficit is expected to reach 10,000 MW by 2030.

In response to this challenge, IEUG was formed with the intention to pool financial resources and procure cost-effective baseload electricity for their members. To date, over 600 MW generation capacity has been secured with investment programs, with an additional 8,000 MW set to come online in the next decade.

Another example of addressing infrastructure constraints through collaboration is the Tonkolili Iron Ore Mine expansion in Sierra Leone. The mine needed an increased rail and port export capacity from 20 to 25 MTPA to support its growth. The mine partnered with a rail operator to implement an improvement program to increase line capacity by identifying bottleneck constraints and implementing operational initiatives in a phased manner. Jointly, they were able to record a 40% improvement in volumes within the first four months.

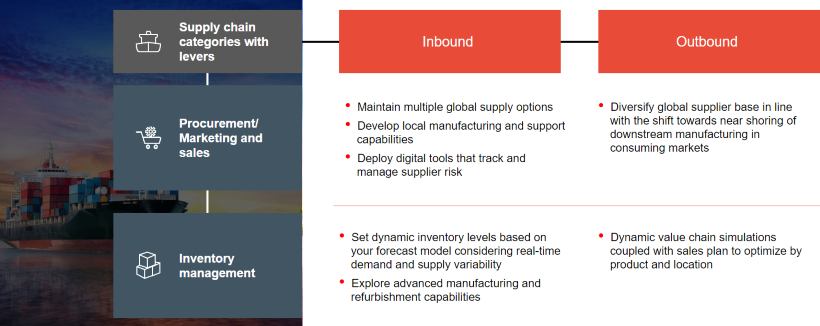

Improving supply chain resilience requires implementation of a combination of initiatives across inbound and outbound supply chains. Increasing resilience of inbound supply chains requires a combination of digital risk exposure and inventory buffer management, as well as diversifying and localizing suppliers and capabilities. Similar to inbound, de-risking outbound supply chains can be achieved through the diversification and nearshoring of customer bases as well as dynamic value chain simulation and optimization.

Supply chain levers

An example of successfully localizing supply chains with an independent power producer focusing on distributed, decentralized, and onsite energy solutions in South Africa, who were able to increase local sourcing to 37%, with plans to further increase to 50%. They were able to achieve this by mapping their components against local manufacturing capacity and engaging with local supply networks, including community-based suppliers.

In another case, a Southern African bulk commodity player wanted to manage outbound supply chain risks. In response, they implemented a digital solution that balances supply and demand and optimizes logistics and inventory management. The solution maximized capacity usage on the export logistics by modelling the entire value chain and reconciling discrepancies between operational and sales plans using real-time data.

In Part 4 of this blog series, we will discuss the key trends that are driving movements on countries and organizations to commit to achieving net zero and carbon neutrality targets. Contact Hatch for further information on how to effectively navigate the current business climate within the mining and metals sectors.

Key trends shaping the mining and metals sector in Southern Africa

- Part 1: Growth and portfolio diversification

- Part 2: Digital

- Part 3: Resilience in an uncertain business environment

- Part 4: Navigating pathways to net zero

- Part 5: Maximizing value from capital spend

Khutso Sekgota

Senior Principal, Hatch Advisory

Khutso Sekgota is a Senior Principal in Hatch Advisory. He supports senior executives in mining, infrastructure, and energy as they set strategy and undertake business transformation programs to pursue growth, improve operational performance, optimize supply chains, and collaborate with stakeholders. He has 15 years’ experience across tier 1 global management consulting firms, having commenced the first 6 years of his career in manufacturing, driving continuous improvement and maintenance management.

Herman Strauss

Principal, Hatch Advisory

Herman Strauss is a Principal in the Advisory practice at Hatch where he supports clients across strategy and planning, deal advisory and implementation, as well as excellence in operations. He started his career at Hatch as a project engineer before joining a global management consultancy where he served mining and energy clients in South Africa, Indonesia, and Singapore. Herman has served clients across areas including strategy, technology enabled operations, restructuring, decarbonization and next zero strategies.