Key trends shaping the mining and metals sector in Southern Africa, Part 4: Navigating pathways to net zero

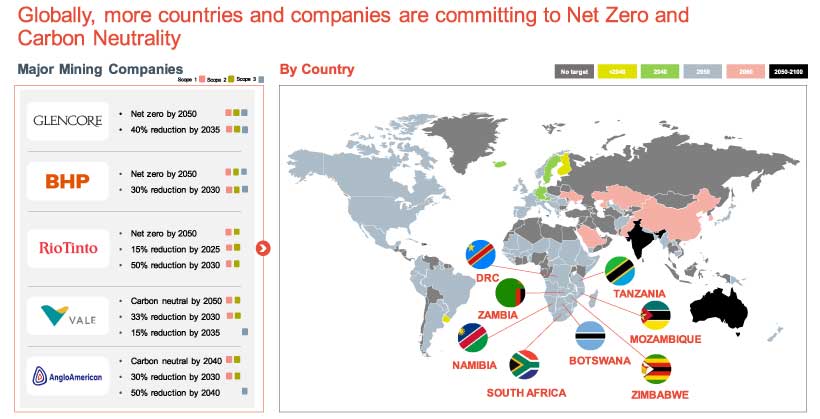

Globally, more countries and organizations are committing to net zero and carbon neutrality. We see countries in Eastern Europe and Asia committing to carbon neutrality by 2060 while the rest of the world has set their targets toward 2050, including Southern African countries. Many major mining companies have set their net zero commitments to 2050, with significant emissions reduction by 2030, with Southern African mining ompanies having set similar commitments. Key trends that are driving global movements on targets arise from stakeholder pressure, policy drivers in key operational locations, competitive advantages for greener products, and the increase in stringent customer requirements across commodity markets.

Net zero commitments by Southern African Countries

Source: https://www.visualcapitalist.com/wp-content/uploads/2021/06/Race-to-Net-Zero-Carbon-Neutral-Goals-by-Country-Full-Size.html

Domestically, we see significant Scope 1 and 2 reduction targets by 2030 that will be unlocked by switching from high grid emissions factor to renewable power alternatives. Most mining activities in Southern Africa lie further upstream in the value chain, where the decarbonization of these processes will be a key requirement for green product demand. Beyond their own operations, mining companies are also under pressure to undertake more Scope 3 abatement by focusing increased attention on decarbonization opportunities and developments in the total value chain.

Organizations are operationalizing their commitments by acting on initiatives spanning three-time horizons. In the short-term, companies are accelerating adoption of renewable power, driven by recent developments such as the removal of 100 MW registration threshold in South Africa, as well as the streamlining of regulatory processes including Independent Power Producers (IPPs) and Virtual Power Purchase Agreements (VPPAs). However, there are still challenges that need to be addressed for the at-scale adoption of renewable energy. These include addressing constraints on grid capacity and infrastructure, frequent changes to regulation, and the high intermittency of solar and wind, which become a challenge at higher penetration of renewable generation.

There are several ways industry players can unlock the next wave of renewable projects and address current challenges. These include moving from on-site to distributed renewable power generation; managing intermittency through hybrid technologies; (e.g., concentrated solar power for process heat, captive vs. wheeling, molten salt storage vs battery energy storage systems, etc.); implementing demand-side levers to optimize load profiles needed when operating at higher renewable generation shares; and collaborating with renewable energy players or aggregators to pool demand.

In addition, we see a focus on accelerating adoption of process efficiency initiatives such as waste heat recovery, use of energy management systems including smart switches and variable speed drives, and advanced process control and productivity improvements.

There are, however, challenges limiting the full value-capture of process-efficiency initiatives. These include the high number of process and energy efficiency projects needed to meaningfully reduce emissions; resource and specialist skill constraints to implement the large number of initiatives; insufficient instrumentation for automation and reporting of energy consumption; competing funding priorities; and marginal business cases due to low energy costs (on a global basis) and limited government and tax incentives.

To fully capture the benefit of the process efficiency initiatives, organizations should consider implementing a carbon lens in the project evaluation, using dedicated teams to drive the portfolio of initiatives, and developing a framework for quick opportunity evaluation and prioritization.

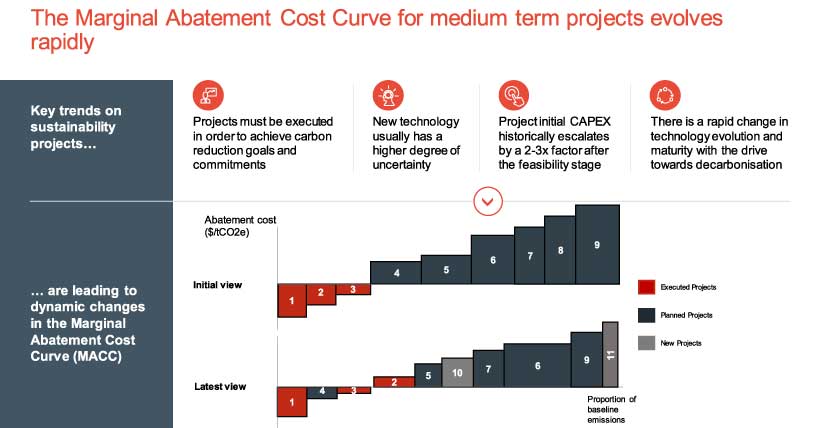

For initiatives that need to come online in the medium-term, projects on the Marginal Abatement Cost Curve (MACC) are evolving rapidly. This is driven by low confidence in capital estimates, evolving regulatory landscape, and rapid changes in technology.

Sustainability projects Marginal Cost Abatement Curve (MACC)

To address the uncertainty of medium-term sustainability projects, increased rigor is needed in the project definition and business case development with earlier collaboration with Original Equipment Manufacturers (OEMs) and development partners. In addition, the MACCs should be seen as dynamic, constantly evolving with new technologies and updated project financials that influence both project-level stage-gate and overall project portfolio decisions.

Long-term decarbonization technologies needed to mitigate hard-to-abate emissions are still at early maturity stages with large investments required to bring them to commercial viability. The maturing of these technologies has long lead-times, making it important to drive required Research and Development (R&D) in a timely manner.

There are two dimensions that drive an organization’s potential approach to R&D. First, the openness of intellectual property, and next, the organization’s ability and/or desire to lead in new technology adoption.

Four quadrants emerge through these two strategic dimensions. Companies who wish to lead in a closed environment need to invest in R&D, secure partnerships with original equipment manufacturers OEMs, or adopt technology from OEMs and research institutions. Fast followers need to evaluate partnerships with research institutions in a closed environment or with OEMs in an open environment.

There are six dimensions companies should consider to successfully achieve their decarbonization goals:

- Abatement curves that focus on realistic estimates that are credible and ensure interdependencies are well considered.

- A multi-pronged approach across energy and process efficiency, technology, and innovation. · Initiatives tailored for greater value and using strategic advantage (e.g., access to renewable energy sources) with

- realistic constraints in the local supply chain.

- The evolution of the organization’s operating model to ensure the decarbonization agenda is embedded into their core business processes.

- Site and front-line level visibility of Greenhouse Gas (GHG) flows.

- Capacity management that enables middle management with resources to execute initiatives.

Contact Hatch for further information on how your organization can most effectively meet its commitments in reaching net zero and carbon neutrality.

In Part 5 of this blog series, we will discuss how the recent uptick in capital spending by mining and metals players has had the potential to reduce project value and success and the approaches owner teams can pursue to navigate these challenges.

Key trends shaping the mining and metals sector in Southern Africa

- Part 1: Growth and portfolio diversification

- Part 2: Digital

- Part 3: Resilience in an uncertain business environment

- Part 4: Navigating pathways to net zero

- Part 5: Maximizing value from capital spend

Khutso Sekgota

Senior Principal, Hatch Advisory

Khutso Sekgota is a Senior Principal in Hatch Advisory. He supports senior executives in mining, infrastructure, and energy as they set strategy and undertake business transformation programs to pursue growth, improve operational performance, optimize supply chains, and collaborate with stakeholders. He has 15 years’ experience across tier 1 global management consulting firms, having commenced the first 6 years of his career in manufacturing, driving continuous improvement and maintenance management.

Herman Strauss

Principal, Hatch Advisory

Herman Strauss is a Principal in the Advisory practice at Hatch where he supports clients across strategy and planning, deal advisory and implementation, as well as excellence in operations. He started his career at Hatch as a project engineer before joining a global management consultancy where he served mining and energy clients in South Africa, Indonesia, and Singapore. Herman has served clients across areas including strategy, technology enabled operations, restructuring, decarbonization and next zero strategies.