How multi-scenario financial modeling can help companies prepare for uncertainty

Unique challenges and opportunities arise for financial modelers and decision-makers trying to work out how to properly evaluate companies and projects amidst the current global economic turmoil. One thing is clear: we cannot continue to rely on single-scenario models to give us the full picture.

Where single-scenario financial modeling falls short

Two key metrics –net present value (NPV) and internal rate of return (IRR)–are typically relied-upon outputs of conventional financial evaluation calculations. But they share a common weakness. They're both based on predictions of future production and cash flows that assume a single set of operating conditions, whatever that definition might be at the time the plans are developed.

These metrics, which use a constant rate of discounting over time, are typically calculated using a "base case" scenario that assumes that the future is a continuation of the past, which is often the only scenario modeled.

In an increasingly globalized society, unpredictable events seem to show a greater propensity for massive worldwide knock-on effects. The COVID-19 pandemic has introduced new uncertainties to supply chains, skilled labor, and production plans for companies across a full spectrum of different industries. Now more than ever "business-as-usual" isn't a likely scenario.

For the times we're living in, single-scenario financial models are simply not sufficient to plan for and be prepared for the range of future outcomes.

How multi-scenario financial modeling is better equipped to handle uncertainty

Scenario-based production modeling is becoming increasingly important to build comprehensive production, cost, and financial models that provide accurate and actionable insights for investors, stakeholders, owners, and project managers. Developing multiple scenarios allows decision-makers to understand and explore a range of risks and opportunities in a consistent calculation before making irreversible decisions.

Considering multiple scenarios is particularly important at this time in light of demand disruptions brought on by the COVID-19 pandemic, as the future may be defined in different ways depending on several uncertain outcomes for key inputs. A range of scenarios allows for diversity and agility within project and planning teams, and it also provides a structured framework for preparedness in the event of a downside scenario. The more we plan and prepare for a range of possibilities, the greater chance we have of achieving success amidst uncertainty.

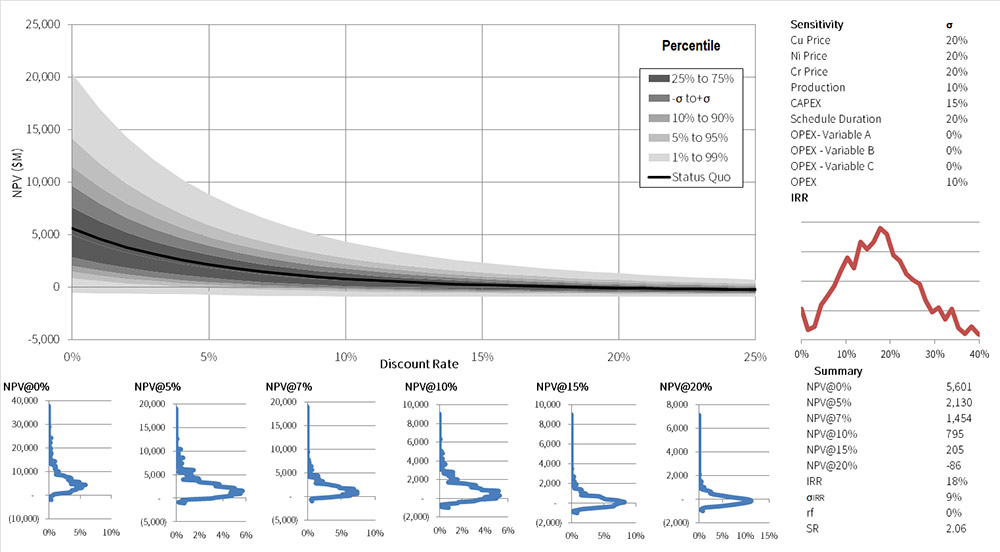

Scenario modeling also allows for the flexibility to test a wide range of uncertain inputs such as commodity price inputs and look at financial metrics such as NPV and IRR, not just as point values but as probability distributions based on the underlying volatility of the input parameters. The figure below shows an example model output IRR and NPV distributions for a project modeled using random variable inputs with a large number of scenarios:

Best practices for developing a multi-scenario financial model

While a financial model can accommodate a very large number of scenarios, it's recommended that at least three be considered: the best case, the downside case, and the upside case. Each of these cases should be developed and considered early on in the project planning process to allow opportunities to be captured and unlikely downside risks to be explored and mitigated. Multiple-scenario financial modeling is most critical before the decision windows, which includes project stage gates, project board approvals, major refinancing, transactions, mergers, and acquisitions.

Scenarios don't need to be overly complex, but should be sufficient to identify and flesh out the downside mitigations and the upside opportunities that need to be investigated. The type, number, and likelihood of scenarios will vary between one business to the next, even within the same industry. Two companies that may have very similar base cases may have very different upside and downside scenarios.

A good rule of thumb to follow is that the base case should represent the most likely scenario, and at a minimum at least one "most likely upside" and one "most likely downside" scenario that's relevant to the key value drivers and goals of your business. You may find it worthwhile to investigate more options to ultimately include them in the base case.

Some of the key areas of uncertainty brought on by black swan events like COVID-19 can be explored and mitigated through upside and downside modeling. These areas include different scenarios for changes in production output, changes in costs, fluctuations in commodity pricing, schedule delays, and changes in legislation.

Managing uncertainty through preparedness

The fact that uncertainty can be modeled mathematically should serve as a form of comfort to people and businesses at this time. While we initially witnessed the exponential growth of COVID-19, we're now beginning to hopefully see the trajectory reversed toward the exponential decay of discounting at a very high rate.

The best antidote to uncertainty is preparedness, and in terms of financial modeling, that includes developing a range of upside and downside scenarios so we're prepared to face whatever the future holds.