It may be surprising to learn that renewable energy technologies, such as solar, wind and electric vehicle batteries, generally require more minerals than their fossil fuel-based counterparts. The IEA’s Net Zero by 2050 emissions scenario forecasts that by 2030 the consumption of lithium and cobalt will rise by sixfold, nickel will increase fourfold and copper twofold.

It may be surprising to learn that renewable energy technologies, such as solar, wind and electric vehicle batteries, generally require more minerals than their fossil fuel-based counterparts. The IEA’s Net Zero by 2050 emissions scenario forecasts that by 2030 the consumption of lithium and cobalt will rise by sixfold, nickel will increase fourfold and copper twofold.

As demand increases for the critical minerals and base metals essential to the development of low-carbon energy solutions, so too will mining. Without sustainable solutions to manage the waste from processing these metals – known as tailings – Australia is likely to face an environmental crisis.

Australia is among the world’s largest producers of six common commodities: copper, gold, nickel, iron ore, coal and bauxite. Copper, nickel and gold are critical for developing solar panels, wind turbines and battery storage, while iron ore, coal and bauxite are critical to develop the steel and aluminium needed to build these. When mining for these minerals, they must be separated from the waste rock – or ore –leaving crushed rock and fine particles in water, which have the potential to damage the environment by releasing toxic metals, causing erosion or sinkholes, and contaminating soil or water supplies. On top of this, there is the energy, carbon footprint, chemicals and labour used to process material that will eventually become a liability that needs to be stored safely for decades to come.

At Hatch, we have undertaken an in-depth analysis to identify the technologies required to reduce or eliminate tailings of these six key commodities. Analysing the different commodities, we investigated how tailings production would be impacted by applying the key technologies ‘themes’: advanced geometallurgy, ore sorting, advanced sensing and particle sorting, in-situ extraction, and preferential fracturing.

Our analysis revealed that technologies available today could reduce tailings by 20% to 30%. Hatch also identified that in the next 10 to 20 years, by integrating these technologies in future projects or expansions, the opportunity exists to reduce tailings by more than 50%.

Jan Kwak

Managing Director, Hatch Australia-Asia

1International Energy Agency (IEA); Schwerhoff and Stuemer (2020); and IMF estimates in IMF, World Economic Outlook, October 2021

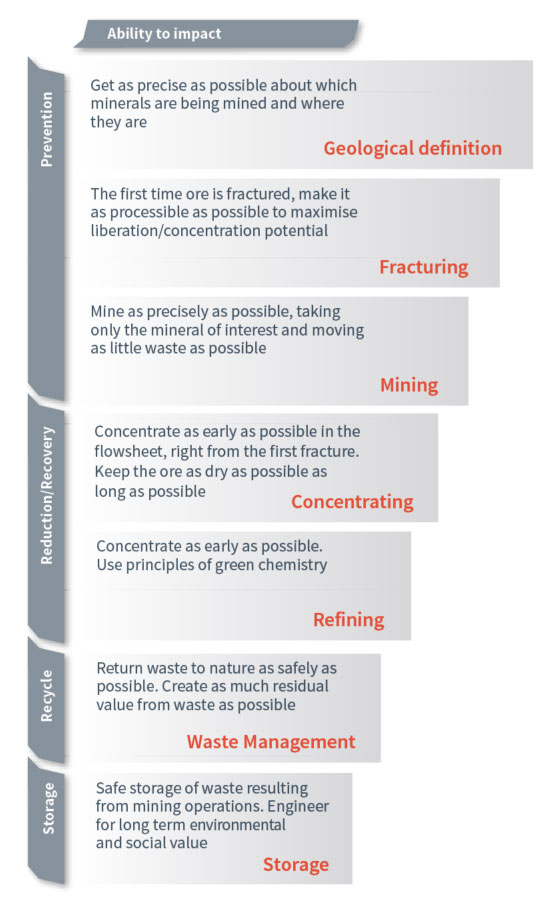

Hierarchy of controls for tailings reduction and elimination

The best approach is to avoid mining tailings altogether. Minimisation of tailings is more effective further upstream in the mining process, through improved geological definition, fracturing and mining technologies.

The second-best approach is to reduce tailings in the concentrating and refining stage of processing. Finally, once tailings are produced, the industry’s only option is to improve waste management practice and ensure safe storage.

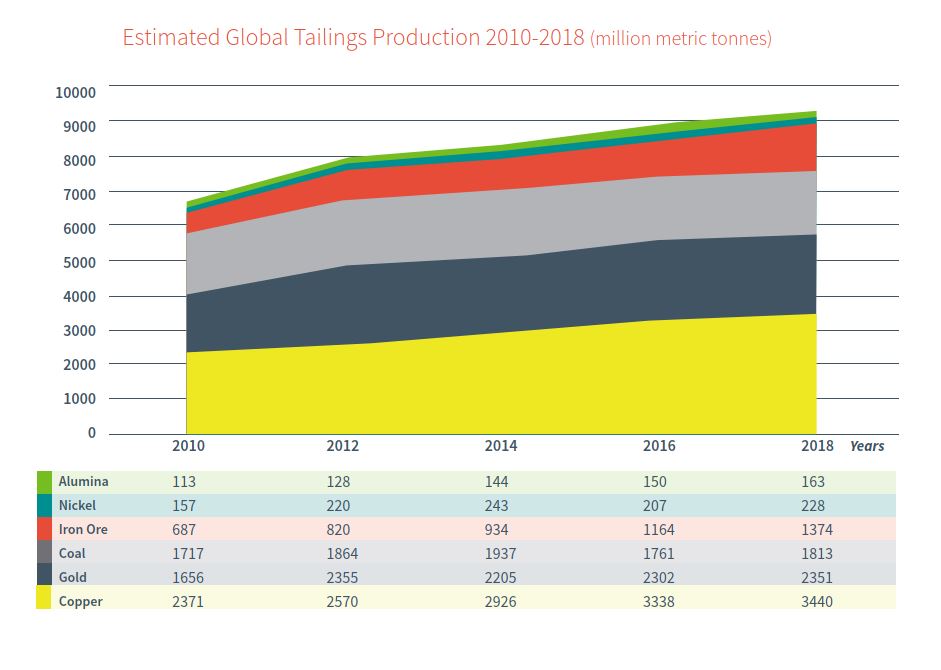

Estimated global tailings production

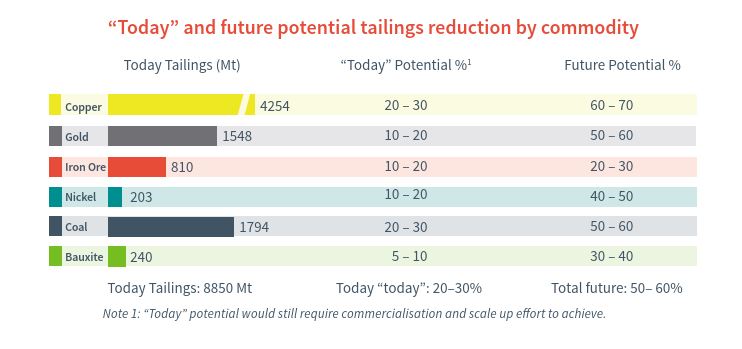

As part of this analysis, Hatch estimated the global tailings production of six key commodities: copper, gold, nickel, iron ore, coal and bauxite between 2010 and 2018.

It revealed that in 2018, tailings production of the six commodities increased, on average, by 40% since 2010 – from 6.7 billion metric tonnes to 9.4 billion metric tonnes. Iron ore tailings had the largest change, increasing 100%, while coal tailings only increased by 6%.

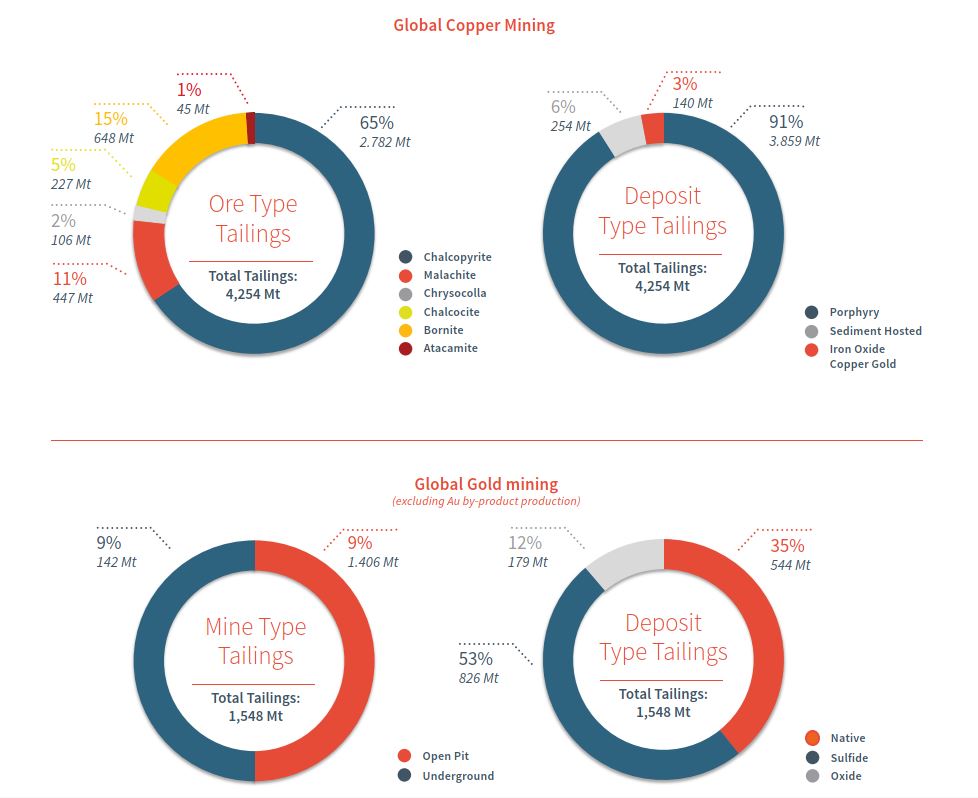

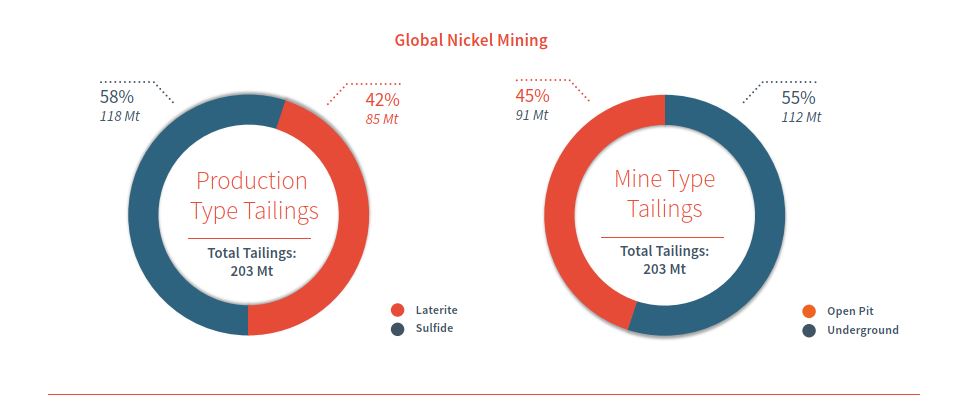

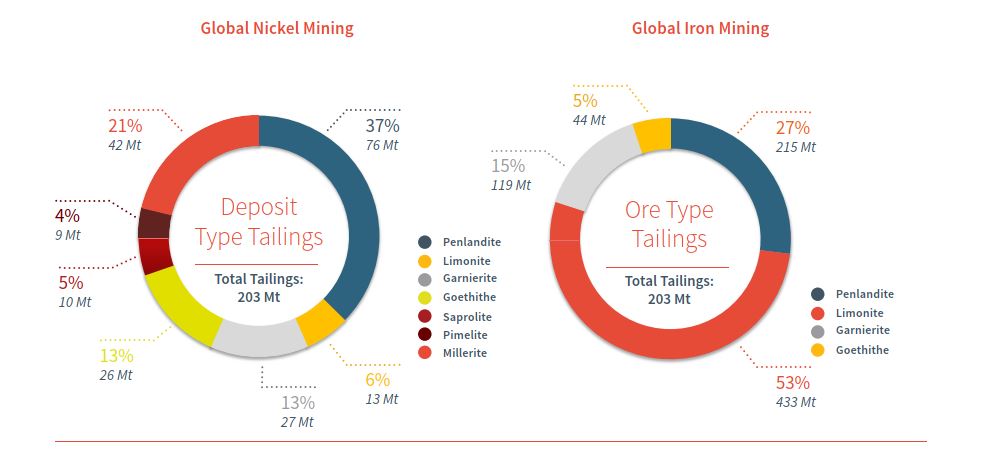

Hatch also assessed the volume of tailings across the six commodities depending on the type of production, mine, ore and deposit. For copper and gold mining, open pit mines produce around 90% of tailings compared to underground mines. While for nickel, open pit mines produce 55% of tailings.

When looking at ore and deposit types, 65% of copper tailings is produced from chalcopyrite – the most common copper ore mineral – and 91% of porphyry deposits. Half (53%) of gold tailings is produced from sulfide deposits, and 37% of nickel tailings are from penlandite (an iron-nickel sulphide mineral) deposits.

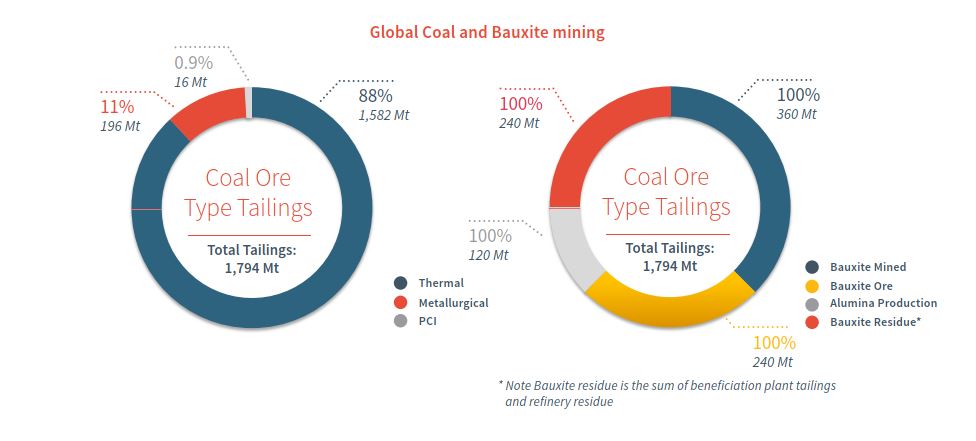

The analysis also revealed that thermal coal produces 88% of coal tailings compared with 11% of metallurgical coal and less than 1% of pulverized coal injection (PCI). Identifying how tailings are produced is critical to establishing the right solutions to reduce and eliminate them. In the example below for copper mining, we can see that 90% of global copper mining is by open pit mining. For the global copper production of 17.1 mt an enormous 4,254 mt of waste is produced. Of the waste produced, that vast majority comes from open pit mining because it is a generally less selective mining method.

Tailings reduction potential

Hatch developed a very high-level estimate for the potential current and future reduction of tailings. Using a ranking system to measure the maturity of technologies, known as Technology Readiness Level (TRL), Hatch graded technologies from zero (idea stage) to nine (commercial application).

The results reveal that current technologies, such as spectral imagining, quantitative minerology and data analytics combined with a geometallurgical approach to mining, have the potential to reduce tailings by 20% to 30%. For simplicity, this approximation assumes that all technologies at TRL 6 or above can be implemented to some degree.

While the two largest tailings producing commodities – copper and coal – have the potential to reduce tailings by 20% to 30% today, this was slightly lower for gold, iron ore and nickel, at 10% to 20%.

Through a concerted, widespread industry effort over the next 10 to 20 years, tailings have the potential to be reduced by 50% or more. For copper, there is the potential to reduce tailings by between 60% and 70% over the next two decades, while iron ore tailings reduction is lowest at 20% to 30%.

The data reveals interesting findings on the future potential for certain commodities. Using today’s technologies, potential reduction in bauxite tailings seems modest at 5% to 10%, however, the data reveals that future advancements could see this increase to 30% to 40%.

Technology solutions:

a roadmap for tailings reduction

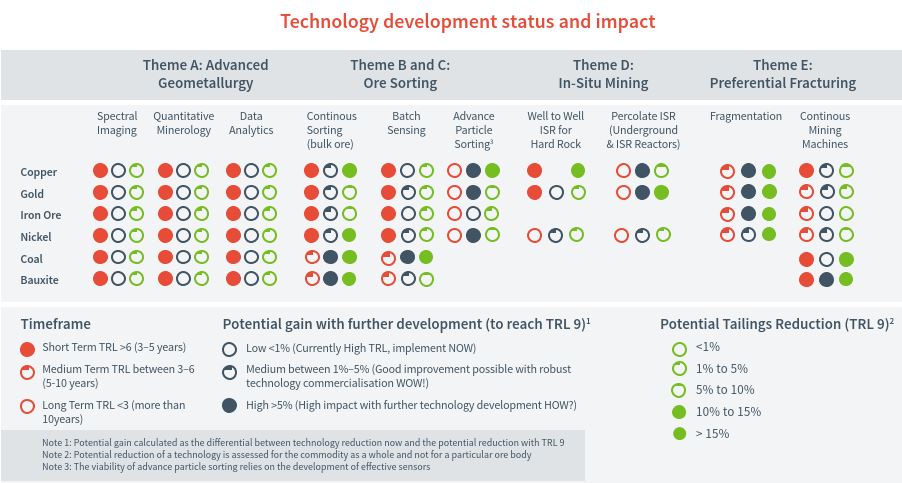

By assessing each technology commercialisation timeline, the potential gain with future development if it reaches a full commercialisation (TRL 9), and the tailings reduction potential of the technology at TRL 9, Hatch identified a roadmap for reducing tailings for the six commodities.

The results reveal that technology focused on bulk ore sorting, advance particle sorting, fragmentation, and In Situ Recovery (ISR) technologies have the highest potential impact on tailings reduction for base and precious metals, specifically for copper and gold.

In relation to bulk materials, such as coal and bauxite, bulk ore sorting and continuous mining machines technologies have a higher potential impact in tailings reduction.

The data also reveals that three technologies – spectral imagining, quantitative minerology and data analytics, when combined with a grade engineering or geometallurgical approach, – can be implemented in the next three to five years across all of the six commodities to reduce tailings

While advanced geometallurgy and sensor technologies (impacting themes A and C) are not shown to have a big impact, they are important enablers for precision mining and grade engineering solutions.

It’s important to note that technology implementation requires a ‘site-by-site’ evaluation and the effectiveness of tailings reduction processes and technology depends on the specific ore mineralogy, orebody characteristics, cutoff grade, mining method and other economic factors.

Challenges of lower TRL technologies

While many advanced geometallurgy technologies have proven commercial application and are assigned with a higher TRL, advanced ore sorting, in-situ mining and preferential fracturing present additional challenges.

Ore sorting

The biggest challenge for ore sorting is finding a solution for in-pit implementation. Advancements in sensor technologies are required, particularly sensor accuracy and speed advancements to allow for increased throughput. Ideally, ore sorting would be the prime lever enabling a full geometallurgical approach to mining.

In-situ mining

There are multiple challenges with implementing this technology, including creating permeability in the ore, reagent selection, reagent consumption, drilling requirements, mass transfer limitations and recovery. Development efforts are particularly required for hard rock applications, and Hatch recommends research should focus on rubblisation of hard rock through advanced fracturing technics such as wireless initiation, automated drilling and explosive charging systems.

This is due to high costs associated with hard-rock drilling and a lack of tools and technologies to understand the host rock and artificially fracture it to improve contact between lixiviants and the target ore metals. This is leading to low recoveries with current lixiviant systems, and a containment risk of lixiviant to surrounding environments.

Another challenge is that in-situ technologies have undeveloped legislation and permitting requirements in many parts of the world.

Preferential fracturing

To develop preferential fracturing technologies, challenges with cutting technology and sensors to guide mining machines for hard rock applications need to be overcome. Fragmentation technologies such as High Voltage Pulse Framentation (HVPF) and laser fragmentation still require further testing and scale-up trials.

Technology stakeholders

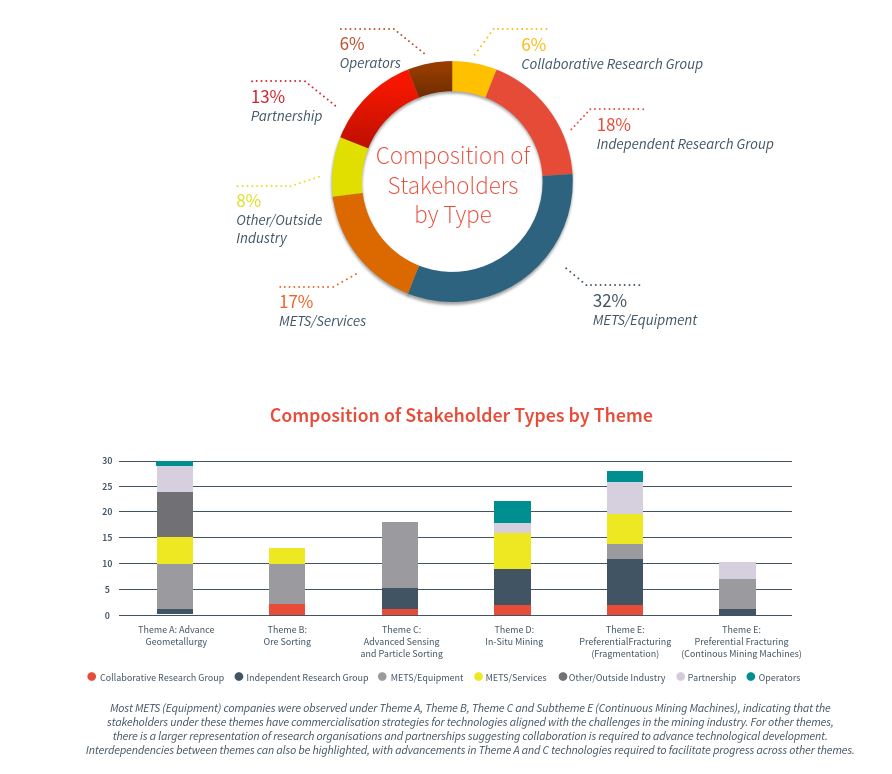

Hatch also undertook a high-level analysis of stakeholders in these technology solutions to identify who is driving their commercialisation.

To solve the complex challenge of reducing tailings, industry collaboration is essential for developing innovative solutions across the entire supply chain. The data revealed a balanced spread of researchers, METS (mining equipment, technology and services) companies, and operators in the mining industry are actively commercialising technologies.

Half (50%) of stakeholders identified are METS companies, whose core business is the supply of equipment and services of these technologies, indicating commercialisation is underway. This group was also present across the technologies that have a higher TRL.

For in-situ mining and preferential fracturing technology themes, which have a lower TRL, there is a larger representation of research organisations and partnerships. This suggests collaboration is required to advance technological development.