Challenges and opportunities in the Peruvian mining sector

Ranking as one of Latin America’s top three economies, Peru offers reasonably stable exchange rates and acceptance of the U.S. dollar in addition to its domestic nuevo sol currency. The country has attracted the world’s most well-established players in the mining space resulting in investment from Brazil, Canada, Chile, China, Japan, the United Kingdom, and the United States, among others. Mining giants like Anglo American, Barrick Gold, BHP Billiton, Chinalco, Freeport-McMoRan, Glencore, Mitsubishi, MMG, Mosaic, and Teck Resources are among the most well-known organizations to have established operations there.

Source: Peru Mining Sector Outlook, BBVA Research, 2023

Peru’s mining sector is on track to exceed pre-pandemic production levels by the end of 2024 with projected growth of at least 5% despite a decline in private investment and the adverse effects of the El Niño weather phenomenon. In addition, Peru has faced political instability in recent years, enhancing the complexities of navigating permit processes for mining exploration and exploitation. Not surprisingly, as a symptom of post-pandemic inflation, Peru’s mining production costs are increasing while profit margins are becoming more challenging to maintain. To combat inflation’s impact, players in the Peruvian mining sector are aggressively looking at ways to optimize production costs through operational excellence and take advantage of opportunities to diversify their operations.

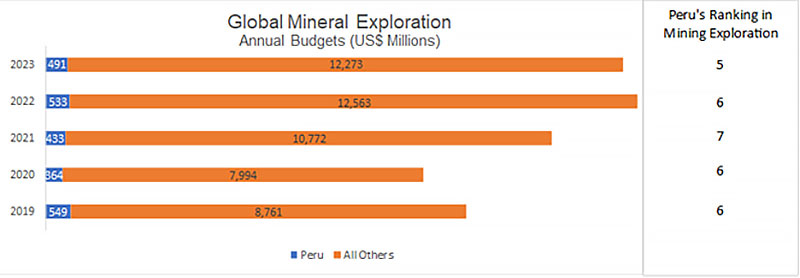

The need for exploration

Peru has significant critical mineral resources such as copper, iron, lead, zinc, bismuth, and manganese, as well as lithium, a metal that is essential in producing electric vehicle batteries and will see a surge in demand due to global interest in green technologies. Although Peru has the potential to become an ample lithium producer, it faces limited exploration, permit and licensing challenges, and competition from other mineral producing nations in attracting investment. The potential for Peru to support climate change initiatives and meet decarbonization standards is enormous and can be achieved through increased investment in mineral exploration as advocated by the Peruvian government.

"Exploration is fundamental for the development of the mining industry. It constitutes the first step of Peru’s most important economic activity as it allows the discovery of new deposits, as well as the extension of the life of operating mines, all of which generates resources for the benefit of the country." Peruvian Ministry of Energy and Mines (MINEM)

Source: Peru General Directorate of Mining Promotion and Sustainability, February 2024

High copper demand and reserves

Copper is the main base metal exported by the country and has pricing that is benefiting from the global economic recovery, stimulus measures in major economies like China and India, and the growing global demand for green technologies. Prices are expected to remain high in the medium term as supply is constrained by operation closures and the lack of new mining projects. Peru could take advantage of these scenarios and maintain its position as the world’s second copper producing nation by increasing its copper production and exports in the coming years. In addition, the anticipated world demand for minerals such as copper, silver, and zinc is expected to increase in value more than fourfold over the next two decades.

Energy transition

Peru has a mixed energy matrix. Its clean power mix consists primarily of hydro (~57%) and combined cycle gas turbine plants (~35%). These flexible energy sources can also integrate renewable technologies like solar and wind (~7%). According to energy regulator, Osinergmin, Peru has the potential to provide up to 80% of its energy supply as renewable by 2030. The projected demand for renewable energy within the country’s mining sector is expected to increase considerably and will require further incentives and investment to implement.

New technologies and innovation

Operational excellence hinges on successfully leveraging technology and digital applications to ensure lean, safe, reliable, and controlled operations that will enable accurate decision-making from any location. Focusing on innovation, introducing new technology and turnaround processes, and acquiring best-in-class industry practices are mandatory to achieving success. The latest technologies also assess critical production drivers and demand a lean and flexible organizational team to integrate and achieve business goals. Additionally, industry players are actively exploring new AI solutions to address on-site challenges, enhance overall operational performance, and prioritize safety.

Decarbonizing the mining sector

The Peruvian mining sector is subject to various regulations ensuring the sustainable use of natural resources, protection of the environment, and the rights of local communities. One of the sector’s main regulating entities is the International Council on Mining and Metals (ICMM), a global industry association promoting responsible mining practices and sustainable development. The ICMM recognizes Peru's progress in implementing decarbonization policies and initiatives in the mining industry but suggests that the country's natural renewable resources have not been developed to their maximum potential.

Peru's major players are ramping up to meet the council's targets to reduce their carbon footprints by 20% to 40% by 2030. To achieve this, mining companies need to increase their share of renewable energy in their current electricity mix by investing in solar, wind, hydro, biomass, and hydrogen projects, or by purchasing green certificates or power purchase agreements (PPAs) from renewable energy providers. The transition to low-carbon fuels and electric transport and mining machinery such as trucks, loaders, drills, and crushers, is crucial.

Tailings solutions

Peru’s main authority overseeing tailings regulations is the Ministry of Energy and Mines (MINEM), which is responsible for issuing the technical norms and standards for the design, construction, operation, closure, and post-closure of all tailings facilities. MINEM has endorsed the guidelines of the Global Industry Standard on Tailings Management (GISTM) for the safe and sustainable management of tailings facilities and has committed to align Peru’s national regulations to support their implementation.

This has resulted in growing constraints for mining operations teams regarding the capacity of storage tailings and continued requirements to reduce contaminants. Standards are becoming increasingly rigorous concerning what mining operations can discharge into rivers or other bodies of water. This has prompted organizations to explore cemented paste backfills (CPB), a technique that mixes mine tailings with water and binders to fill the underground voids left by mining. CPB has several advantages over tailings ponds, including the stability and productivity of mines by preventing ground subsidence and allowing faster mining cycles while creating safer and cleaner working environments for miners and surrounding communities. CPB is a promising technology that can help the mining industry achieve sustainability and cleaner production goals.

Conclusions

The Peruvian mining sector can significantly benefit from the inclusion of new technologies and standards for the application of renewable energy in its operations, as it can reduce costs, increase competitiveness, enhance social and environmental performance, and foster the development of local communities while creating shared value. Achieving this will also create notable value for stakeholders, potentially contributing to increased foreign investment and exploration in the country’s abundance of natural resources.

Peru’s mining sector is not only a key driver of its economic growth, but also a source of innovation and competitiveness in South America. Peru’s mining achievements and potential make it a country to watch by other metals investors and producing nations.