Assessing the impact of federal funding mechanisms on the North American electric vehicle value chain: Part 1

Still, the outlook towards electric vehicle adoption is becoming increasingly optimistic across North America, with scenarios ranging from 30 to over 50 percent based on new vehicle sales by 2030. The administration’s US$920 billion in new federal investments between the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) have already resulted in major private sector developments across the electric vehicle value chain; from raw material through battery production, industry stakeholders have announced large-scale projects that align with broader near-shoring and economic growth objectives. In 2022, automakers announced over US$73 billion in plans for U.S. battery factories, with billions more allocated for sourcing and technological innovation initiatives.

Still, these federal investments introduce significant complications spanning from manufacturer tracing regimes to project permitting and diplomatic considerations. Ensuring successful implementation will require delicate coordination between agencies, governments, and sectors for the industry to meet the momentum required to fuel decarbonization over the next decade.

The Inflation Reduction Act’s battery material requirement

The IRA may be one of the most favorable tailwinds for bolstering North America’s electric vehicle ecosystem; it is also perhaps the most complex in terms of implementation. Specifically, details related to electric vehicle tax credit eligibility based on critical materials and battery components require clarification before manufacturers break ground on projects and carry out planned investments.

Final Department of Treasury regulations and Internal Revenue Service (IRS) guidance—initially expected in December and now expected to be finalized this March—will tie the US$7,500 credit to a critical mineral and a battery component requirement, with each requirement associated with half of the total credit:

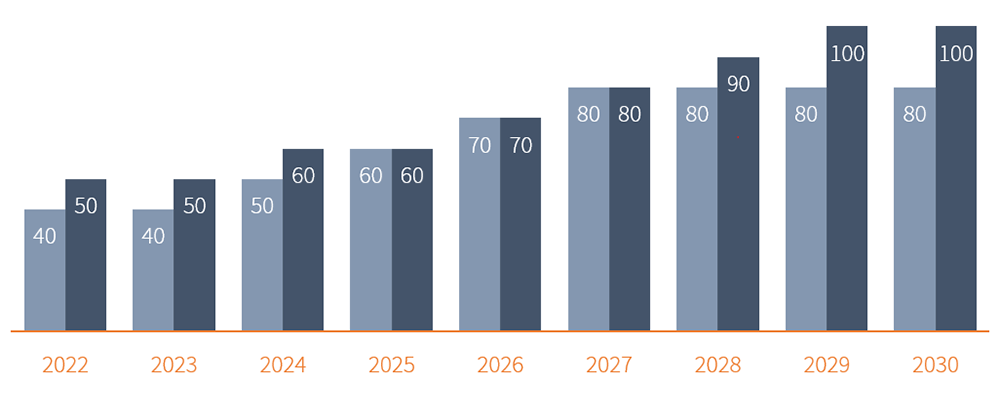

Critical minerals requirement: Requires a share of the battery’s critical minerals be extracted or processed in the U.S. or in a country with which the U.S. has a free trade agreement or sourced from material recycled in North America. The share rises 10 percent annually starting with a minimum of 40 percent in 2023 and reaching 80 percent after 2027.

Battery component requirement: At least half of the vehicle’s battery components—including its battery cells and modules—must be manufactured or assembled in North America starting in 2023. That share rises to 60 percent in 2024 and 2025 and increases gradually to 100 percent by 2029.

Breakdown of IRA critical mineral and battery component requirements (%)

- Critical Minerals Requirement

- Battery Components Requirement

Ambiguity around these requirements—the tests for determining domestic content and the steps required by automakers to meet them—has resulted in widespread speculation regarding eligibility. The Department of Treasury’s response to publish a white paper in late December and seek further comment on implementation has managed to generate even more questions.

Major automakers have released public comments urging an inclusive interpretation from the Department of Treasury and the IRS. Several specifically noted that current supply chains are insufficient to meet near-term demand; in effect, the ambitious timelines set out by the IRA will require interpretive flexibility.

In addition, many foreign governments have criticized the broader tax credit provisions, which in effect form a non-tariff barrier for the import of everything from battery minerals to component parts and vehicles assembled in Europe and Asia.

Stakeholders have also raised concern over the enforcement regimes that will be required to oversee reporting for meeting each requirement, which presents a handful of regulatory considerations for the public and private sectors alike.

Delays in publishing the guidance and details suggest that both the Treasury and the IRS are weighing the concerns expressed by automotive assemblers, battery manufacturers, mining interests, and foreign governments carefully. In any case, once the guidance is released later this month a significant industry response can be expected, which may include a race to announce—or reevaluate—capital projects and overarching sourcing strategy objectives.

How Hatch can help

Our battery market solutions team has worked with clients across the value chain—from raw material producers to battery and vehicle manufacturers— to evaluate, optimize, and implement strategic initiatives and major capital projects in consideration of federal funding opportunities and requirements. We take tremendous pride in bridging technical expertise with management consulting excellence and our collaborative approach for delivering actionable outcomes.

Authors

Mariam Faizal

Mariam Faizal

Senior Analyst

Advisory Jan Maceczek

Jan Maceczek

Senior Consultant

Advisory Yinka Ogunduyi

Yinka Ogunduyi

Engagement Manager

Advisory Siddarth Subramani

Siddarth Subramani

Principal

Advisory