Planning for the Growth of Electric Vehicles in North America

Considering a bottom-up estimation approach, it is fair to say that the demand for the EVs will be driven by socioeconomic factors such as income, education, and home ownership. Demand may also be affected by government mandates and incentives. For example, California’s rapid EV adoption rate is largely concentrated in high-income neighborhoods. Nevertheless, we shouldn’t ignore the fact that California’s government offers numerous income-based incentives in which residents can receive grants and other state-funded assistance – at times $10,000 or more – to purchase zero-emission vehicles. That translates to about a third off an entry-level Nissan Leaf! These incentives helped California become the first state in the US to sell more than one million EVs. Conversely, EV sales dropped significantly in Ontario, Canada after the provincial incentive was removed in 2018. That said, one could argue that more incentives, greater competition, and lower overall prices, will eventually contribute to a greater demand for EVs. There are, of course, other economic factors to consider. In 2022 alone, increasingly expensive gasoline prices fueled ever-growing waitlists for some EV models.

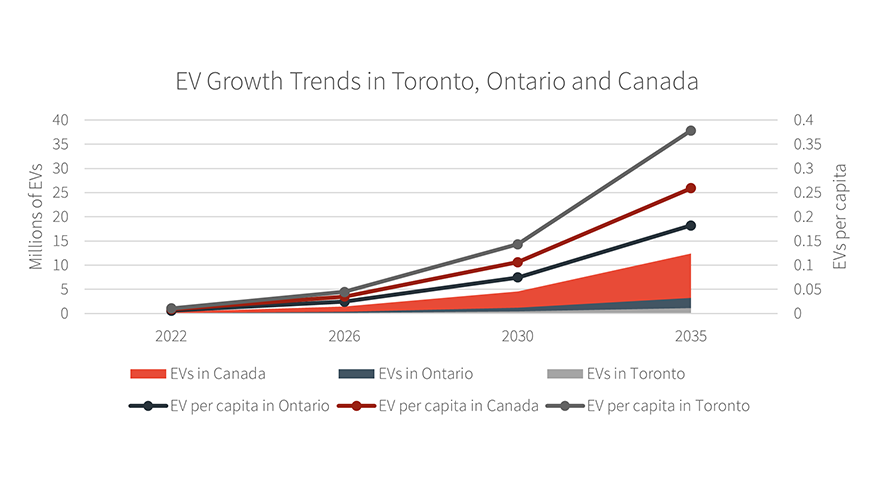

Another contributing factor has been the Canadian government’s mandate that 100% of new light-duty cars and passenger truck sales be zero-emission by 2035. This is anticipated to lead to 1.4 million zero-emission vehicles (ZEVs) by 2026 (about 5% of all the light-duty vehicles expected to be on the road by then), 4.6 million by 2030 (about 16% of all light-duty vehicles); and 12.4 million by 2035 (about 40% of all light-duty vehicles)1. In Ontario, the IESO Annual Planning Outlook projects 6.6 million EVs in Ontario by 20422. And what are the numbers now? Canada currently has 316,379 registered ZEV as of Q2 2022, which includes 81,597 in Ontario, and 28,612 in Toronto3. This means we will need to quadruple what is on the road now in only 4 years, then triple (that’s 12 times) in another 4 years, and then triple again (almost 40 times) in another 5 years to make it 12.4 million ZEVs Canada-wide by 2035. Assuming similar growth across Canada, we will see 400,000 ZEVs in Toronto by 2030, and 1.1 million by 2035. Put another way, one out of every four Canadians will own an EV.

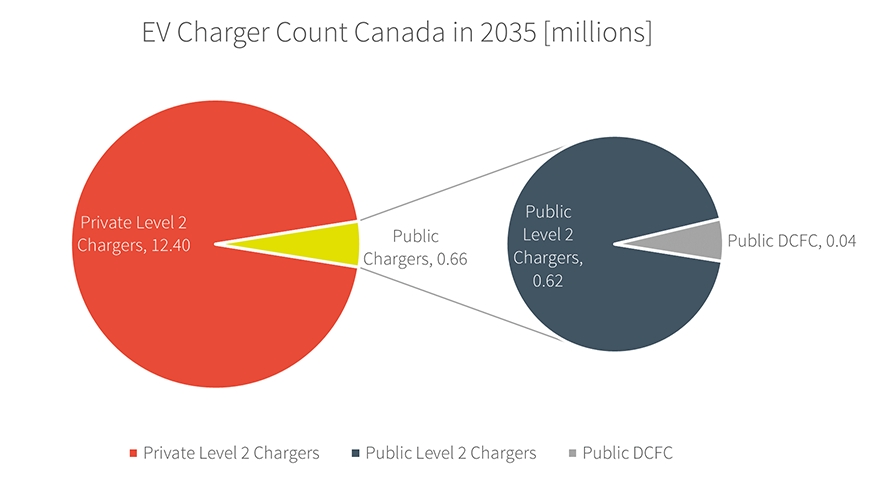

So, how many chargers will these EVs need? Metropolitan areas in North America are expecting EV-to-charger ratios of around 300 vehicles sharing one public DC fast charger (DCFC), and around 20 vehicles sharing one public Level 2 charger. A Level 2 charger takes approximately 2.5 hours to charge one EV for a 100 km range, and a DCFC takes about 25 mins for the same scenario. With such charge times and EV-to-public ratios, it is expected that most EV owners will install Level 2 chargers at home instead of competing for a public charger.

If that’s the case, doing some quick math using the above ratios, by 2035 Canada will need: 40,000 DCFCs, 620,000 public Level 2 chargers, and about 12 million private Level 2 chargers. Imagine how much additional load these chargers will bring to the electric grid if not managed!

Many utilities have already started planning and initiating pilot programs studying future EV and EV supply equipment (EVSE) growth trends and people’s charging behaviors in their service territories. This will help with their systems and investment planning priorities as expansions will likely be needed to accommodate the increasing loads. Developers and homeowners can also investigate charging management systems or building energy management systems to perform “smart charging” and reduce coincident loads, especially during peak load hours. Governments and regulators may investigate innovative electricity rate programs or incentives to encourage people to charge during off-peak hours. All stakeholders can help, and people should act NOW!

As a global engineering and consultancy company headquartered in Canada, Hatch has a broad perspective on power sector issues that allows us to identify best practices for a variety of risk factors and conditions. Our Power business unit is made up of specialty groups focusing on transmission and distribution, smart grid and asset management, microgrid and hybrid power systems, hydropower, renewable power, thermal power, and nuclear power. We are further supported by several speciality teams, including Advisory (consulting and business improvement), Digital, and Environmental Services. The growth of EVs is, of course, not limited to light-duty vehicles. EVs are used in the infrastructure sector, which is why we also collaborate with our Urban Solutions, Transit, and Transportation teams. We work with a variety of clients worldwide, including utilities, governments, and regulators. We have partnered with our clients to create unprecedented outcomes, applying our engineering and business knowledge to solve the world’s toughest challenges. Regardless of project size, we build practical solutions that are safe, innovative, and sustainable.

1 Canada's Zero-Emission Vehicle (ZEV) sales targets

2 Annual Planning Outlook (ieso.ca)

3 New zero-emission vehicle registrations, quarterly (statcan.gc.ca)

Xiaoyou Zhang

EIT, Smart Grid

Xiaoyou is a Smart Grid EIT with proficient knowledge of grid modernization, EVs, DERs, renewable energy resources, transmission and distribution networks, power system protection, power electronics, electricity markets, and microgrids. She is actively engaging in various projects such as Grid Modernization, Grid Electrification, EV Future Growth, and Utility Asset Management. Xiaoyou holds both Master and Bachelor of Applied Science in Electrical Engineering from University of Waterloo. She has co-authored several journal and conference papers on the protection of power lines connecting to DERs and other renewables. She is also a member of IEEE and a registered EIT at Professional Engineers Ontario (PEO).