Breaking the paradigm: balancing performance, cost, and risk using risk-based asset management

1. The right risk-based asset management plan starts with the right team

To build an effective asset management plan and deliver it, you need the right team. From our experience, the right team includes project managers, asset management specialists, and technology subject matter experts (SMEs).

- Project managers provide the process expertise and key project management oversight that enables value capture, risk mitigation, organizational design, and enablement.

- Asset management specialists provide industry-specific knowledge in the field of asset management.

- Technology SMEs bring a broad spectrum of solutions across an industry’s value chain, often leveraging experience from other industries.

The right team with the right perspective prevents the blind application of technology which can result in your digital transformation or asset management initiatives failing to deliver their intended value. Together, these three core centers of excellence ensure that the anticipated value is captured through collaboration and throughout the implementation of the asset management plan.

2. Fixing the root cause vs. treating the symptoms

With the right team assembled, a systematic risk assessment should be performed. Risk mitigation follows a structured approach that breaks down the reliability and risk of failure. It takes a commitment to time and doing your homework. While it can be more challenging, it’s also more constructive and worthwhile to dig deeper to identify and treat the systemic source of the problem. Once we know what the root cause is, we can brainstorm action plans on how to mitigate those risks with novel people, process, and technology solutions.

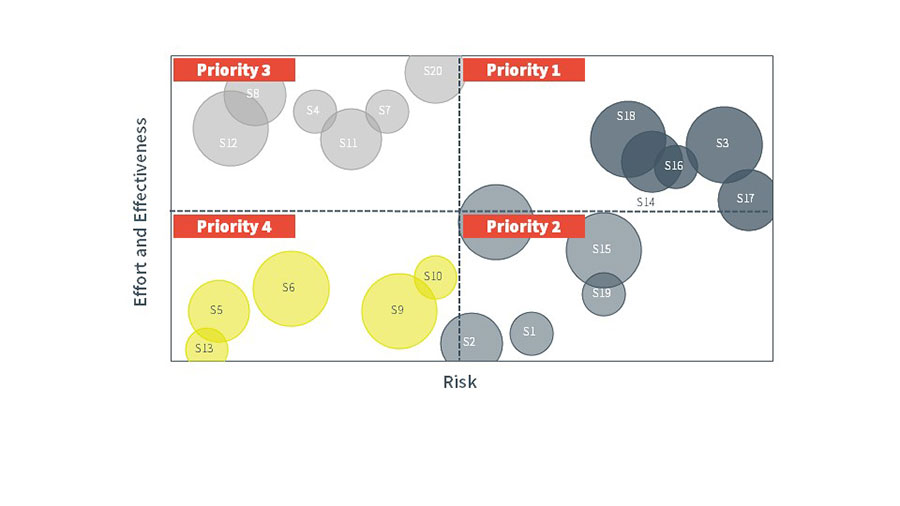

With a list of potential solutions, we need to prioritize actions for maximum impact. Similarly, the process of prioritizing actions should follow a structured approach that allows you to quantify the effort, effectiveness, and organizational sentiment of the initiative while mapping it to the specific risk being mitigated.

3. Switching from a consumable model to a reliability-centered maintenance model

To help visualize the impact of effective asset management, let’s look at a furnace rebuild schedule as an example. As time goes on, equipment deteriorates and the risk of failure increases. At some point, that risk reaches a theoretical maximum acceptable level. The maximum acceptable level is usually derived from experience, data analytics, or precedent, but is rarely defined with precision and is a moving target. At this maximum acceptable level, a rebuild or a major maintenance investment is required.

But that model is losing popularity because significant value is left on the table and operators are realizing the upside of understanding asset health, incorporating improved design changes and improving monitoring, and operations and maintenance practices.

By implementing the right people, process, and technology controls–defined by following a risk-based asset management approach–you’re better able to understand and treat the risks to your asset. By better understanding and treating risk, you can make decisions that optimize the value of your assets across their lifecycles: prolonging their lives, reducing downtime and, at times, increasing production throughout.

We’ve seen three-fold increases in the operating lives of critical integrity equipment. We’ve seen tens of millions of dollars in overhaul spending and significant production outages deferred. But most importantly, we’ve seen firms completely change the way they view their assets–from consumable to maintainable–enabling them to build more profitable, reliable, and resilient businesses.

.png)